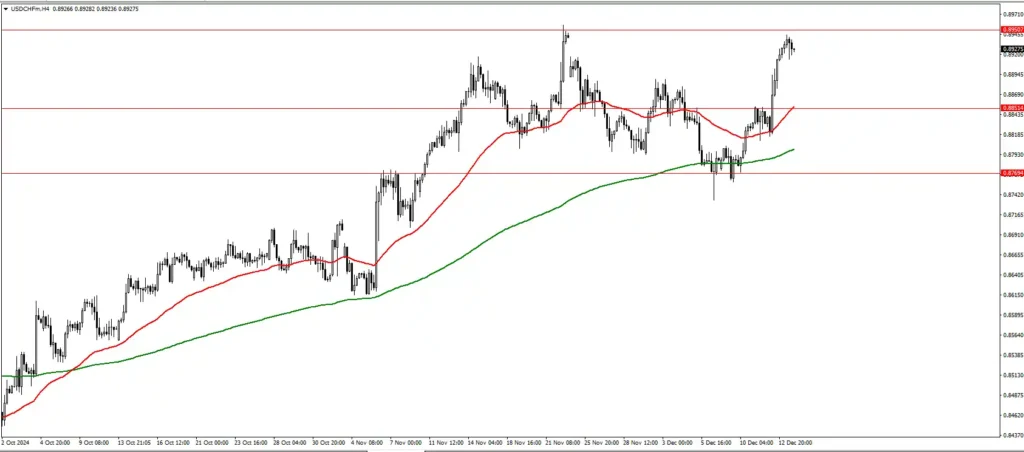

The USD/CHF pair showed strong bullish movement last week, trading between 0.8750 and 0.8950. It ended the week near the upper end of this range, closing at 0.8930, and approaching a critical resistance level at 0.8950. As the price nears this level, sellers are expected to become more active, while buyers may proceed with caution.

Technical Analysis

The 0.8950 level is a key resistance for USD/CHF. If sellers successfully defend this level, the price may reverse, with the first support target at 0.8820. A further bearish move could push the pair toward 0.8770, providing significant downside potential for sellers.

However, if the price breaks above 0.8950 and holds, it could signal continued bullish momentum. In this case, the next key target for buyers would be 0.9030.

Fundamental Insights

Several factors and upcoming events could impact USD/CHF:

- US Federal Reserve Economic Outlook: On 16 December, the Fed will release its updated economic projections. Hawkish signals, such as maintaining higher interest rates or forecasting strong economic growth, could strengthen the USD and support further gains for USD/CHF.

- Switzerland Trade Balance Data: Switzerland will release its trade balance report this week. A weaker-than-expected report could pressure the Swiss Franc, supporting the USD/CHF’s upward movement.

- US Retail Sales Report: US retail sales data for November is set to be released. Strong consumer spending could bolster the USD, further reinforcing bullish sentiment for USD/CHF.

- Geopolitical Tensions: The Swiss Franc often acts as a safe-haven currency in times of global uncertainty. A reduction in geopolitical tensions could decrease demand for the Franc, allowing the USD to dominate.

Forecast and Key Levels to Watch

Based on the current technical and fundamental outlook, the following levels are crucial for USD/CHF traders:

- Resistance: 0.8950, 0.9030

- Support: 0.8820, 0.8770

In the short term, the price may face resistance at 0.8950, with sellers potentially pushing it lower. However, if the price breaks above this resistance and sustains it, the bullish trend could continue.

Conclusion

USD/CHF is at a key juncture with the 0.8950 resistance level acting as a critical point for its next move. While sellers may dominate at this stage, a breakout above this resistance could shift momentum in favor of buyers. Traders should watch for important economic releases on 16 December 2024, as they are likely to influence the pair’s direction.

Click Here For Free Forex Signals