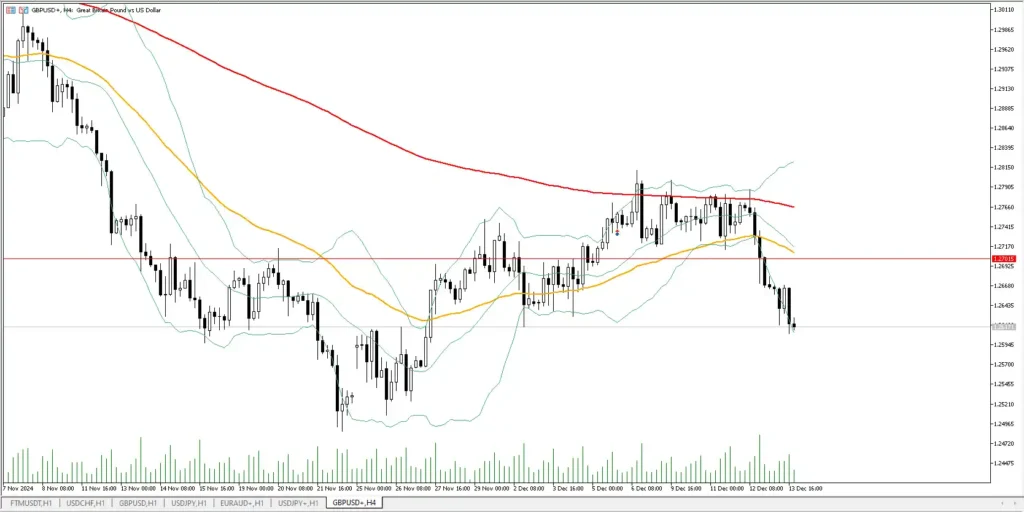

The GBP/USD pair closed last Friday at 1.2717, continuing its bearish momentum. Despite attempts to rally and test the 200 EMA on the 4-hour chart, these attempts were unsuccessful. The price eventually turned bearish, falling from the 1.2800 level and moving toward 1.2600.

Technical Analysis

Currently, the key resistance levels are at 1.2700 and 1.2760, which are limiting any potential upward movement. On the downside, immediate support is found at 1.2600, with a broader target at 1.2530 if the downtrend persists.

The rejection from the 200 EMA on the 4-hour chart underscores the overall bearish sentiment. Additionally, the moving averages and recent lower highs suggest that the downtrend is likely to continue.

Fundamental Insights

Several factors are influencing the GBP/USD pair:

- UK Economic Concerns: The UK economy faces challenges such as high inflation and stagnant growth, which are putting pressure on the Pound. Recent data showing a contraction in retail sales has added to the negative outlook.

- Bank of England’s Caution: The Bank of England (BoE) has taken a more dovish approach, signaling a potential pause in its interest rate hikes. This contrasts with the Federal Reserve’s hawkish stance, supporting the US Dollar against the Pound.

- US Dollar Strength: The US Dollar continues to be supported by strong economic data and the Fed’s higher-for-longer interest rate policy. This divergence between the BoE and the Fed further pressures the GBP/USD pair.

Forecast for 16 December

In the short term, the GBP/USD pair is likely to remain under downward pressure. If the price stays below the 1.2700 resistance level, it could test the 1.2600 support level. A decisive break below 1.2600 may lead the pair toward 1.2530.

However, any positive surprise in UK economic data or a shift in market sentiment could trigger a corrective rebound, targeting the 1.2760 resistance level.

Key Levels to Watch

- Resistance: 1.2700, 1.2760

- Support: 1.2600, 1.2530

Conclusion

With the current technical and fundamental factors favoring a bearish outlook, GBP/USD is likely to continue facing downward pressure. Traders should monitor the key resistance and support levels closely, along with any significant economic data releases from the UK and the US.